Tawuniya Insurance Company, officially known as The Company for Cooperative Insurance (Tawuniya), is one of Saudi Arabia’s most successful and reputable insurance companies. Established in 1986, Tawuniya is the first insurance provider licensed to operate under the Cooperative Insurance principle, which aligns with Islamic values and Shariah principles. Over the years, the company has grown into a market leader in the Kingdom’s insurance sector, offering a diverse range of insurance products, including health, motor, property, and life insurance. This article explores the factors behind Tawuniya’s success, delving into its history, business model, product offerings, financial performance, competitive advantage, and future prospects.

1. Historical Background of Tawuniya Insurance Company

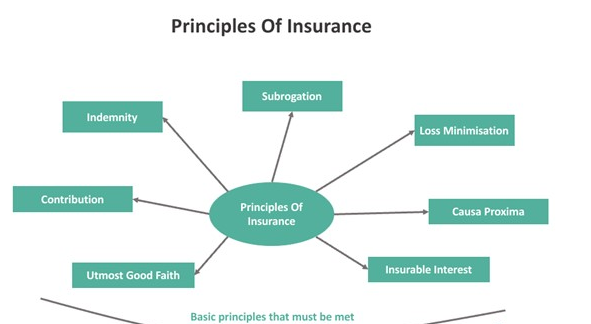

Tawuniya was founded as part of the Saudi government’s efforts to establish a formalized insurance industry that adhered to Islamic principles. Cooperative Insurance, which forms the basis of the company’s operations, ensures that policyholders share in the profits and losses of the insurance pool. This structure is in contrast to conventional insurance, where shareholders typically benefit from the profits generated.

The company initially focused on basic insurance services, such as motor and property insurance, but rapidly expanded its offerings in response to the growing demand for more comprehensive coverage. Over time, Tawuniya became a pioneer in the Saudi insurance industry, spearheading the development of a formal regulatory framework for the sector.

2. Business Model and Organizational Structure

Tawuniya operates under a cooperative business model, which sets it apart from many global insurance companies that operate under conventional models. The Cooperative Insurance model emphasizes mutual cooperation, where policyholders share in the pool of funds, and surplus amounts after claim settlements are returned to policyholders. This not only builds trust with customers but also reinforces Tawuniya’s alignment with Islamic ethical values.

The company’s organizational structure is divided into various business units, each focusing on different insurance segments. These units include:

- Health Insurance: The largest and most profitable unit, covering a significant portion of the Saudi population.

- Motor Insurance: One of the most competitive segments, where Tawuniya maintains a leading position.

- Property and Casualty Insurance: Covering commercial and personal properties, this unit also handles fire, engineering, and marine insurance.

- Life Insurance (Protection and Savings): Although relatively new compared to other segments, life insurance has been growing in demand, driven by a higher awareness of financial planning among Saudis.

3. Key Products and Services

Tawuniya has a wide array of insurance products tailored to meet the needs of both individual and corporate clients. Its product portfolio is diverse, ranging from compulsory insurance products like motor and health insurance to more niche offerings such as liability insurance and marine coverage.

3.1 Health Insurance

Health insurance is the most significant business segment for Tawuniya, accounting for a large portion of the company’s revenue. The company offers a variety of health insurance plans, including the Medgulf Health Insurance Plan, which is designed for expatriates, and Al Shamel, a comprehensive plan for families and individuals. Tawuniya’s health insurance offerings are highly competitive due to their extensive hospital network and excellent customer service.

With the Saudi government’s enforcement of compulsory health insurance for all expatriates and their dependents, Tawuniya has been able to tap into a significant market. Moreover, as awareness about the importance of health insurance increases among Saudis, the company’s health insurance portfolio continues to grow.

3.2 Motor Insurance

Motor insurance is another major product offered by Tawuniya. The company offers both Third-Party Liability (TPL) insurance, which is mandatory in Saudi Arabia, and Comprehensive Motor Insurance, which covers damage to the insured vehicle in addition to third-party liabilities.

Tawuniya’s motor insurance policies are known for their competitive pricing and the wide range of coverage options. The company also offers value-added services such as roadside assistance and repair services, which further enhance customer satisfaction. The popularity of these offerings has helped Tawuniya secure a substantial share of the Saudi motor insurance market.

3.3 Property and Casualty Insurance

Tawuniya offers a variety of property and casualty insurance products, catering to both individuals and businesses. For individuals, the company offers Home Insurance, which covers property damage from natural disasters, theft, and fire. On the corporate side, Tawuniya provides Commercial Property Insurance, Liability Insurance, and Engineering Insurance, which are tailored to businesses in industries such as construction, real estate, and manufacturing.

One of the unique offerings in Tawuniya’s portfolio is Marine Insurance, which covers cargo and vessels. This product is especially relevant in a country like Saudi Arabia, where import and export activities are critical to the economy.

3.4 Life Insurance (Protection and Savings)

While life insurance in Saudi Arabia is still in its growth phase, Tawuniya has positioned itself as a pioneer in the Protection and Savings Insurance sector. The company offers a range of life insurance products designed to provide financial security to families in the event of the policyholder’s death, disability, or critical illness. The life insurance products are structured to be Shariah-compliant, ensuring that they meet the religious and cultural expectations of the Saudi market.

4. Financial Performance and Market Position

Tawuniya’s financial performance over the years reflects its successful business strategy and dominant position in the Saudi insurance market. In 2023, the company reported gross written premiums (GWP) of over SAR 9 billion, making it one of the largest insurance companies in the Kingdom by revenue. This strong financial performance has been driven by robust growth across its core business segments—particularly health and motor insurance.

4.1 Profitability and Solvency

Tawuniya has consistently maintained strong profitability, driven by its disciplined underwriting and cost management practices. In recent years, the company has achieved an average return on equity (ROE) of around 12%, reflecting efficient capital allocation and strong operational performance.

The company’s solvency ratio, a key measure of financial health, has consistently remained above regulatory requirements, ensuring that Tawuniya has sufficient capital reserves to meet its obligations to policyholders. This financial strength has earned the company favorable ratings from global credit rating agencies such as Moody’s and Standard & Poor’s.

4.2 Market Share

Tawuniya enjoys a dominant market share in the Saudi insurance sector, accounting for approximately 20% of the total market in terms of gross written premiums. The company’s leadership position in the health insurance segment has been particularly strong, where it serves some of the Kingdom’s largest corporations and government entities.

In addition to its leadership in the health insurance market, Tawuniya also holds a significant share of the motor insurance market, thanks to its comprehensive and competitive product offerings. The company’s consistent market performance has established it as a trusted and reliable insurer in the Kingdom.

5. Competitive Advantage

Tawuniya’s success in the highly competitive Saudi insurance market can be attributed to several key competitive advantages:

5.1 Strong Brand Recognition and Trust

Tawuniya has built a strong reputation as a trusted insurance provider over its three decades of operation. Its cooperative insurance model, which aligns with Islamic principles, has helped the company establish a unique identity in the market. The company’s brand is synonymous with trust, reliability, and customer service, which gives it a distinct advantage over newer entrants to the market.

5.2 Wide Product Portfolio

The company’s wide range of insurance products allows it to cater to diverse customer needs, from individuals seeking basic motor or health insurance to corporations looking for comprehensive risk management solutions. This product diversification has enabled Tawuniya to capture a larger share of the market and reduce its dependence on any single business segment.

5.3 Strong Customer Service and Digital Transformation

Tawuniya has invested heavily in customer service, with a focus on improving the customer experience through digital channels. The company offers online policy management, claims filing, and customer support services, which have made it easier for customers to interact with the company. This digital transformation has also improved operational efficiency and reduced costs.

5.4 Regulatory Compliance and Shariah Adherence

Operating in a country where adherence to Islamic principles is paramount, Tawuniya’s commitment to offering Shariah-compliant insurance products has earned it the trust and loyalty of the local population. The cooperative insurance model is well-suited to the cultural and religious context of Saudi Arabia, providing Tawuniya with a competitive edge over conventional insurance companies.

6. Strategic Initiatives and Future Prospects

As the Saudi insurance market continues to evolve, Tawuniya is well-positioned to capitalize on emerging opportunities and navigate potential challenges. The company’s strategic initiatives focus on growth, innovation, and operational excellence.

6.1 Expansion into New Markets

Tawuniya has expressed interest in expanding its footprint beyond Saudi Arabia, particularly in other Gulf Cooperation Council (GCC) countries. This regional expansion would allow the company to tap into new markets with similar regulatory environments and cultural contexts. Tawuniya’s strong brand and product portfolio could be leveraged to capture market share in neighboring countries.

6.2 Investment in Technology and Innovation

The digital transformation of the insurance industry presents both challenges and opportunities for companies like Tawuniya. The company is investing in new technologies such as artificial intelligence (AI) and big data analytics to enhance its underwriting processes, improve customer service, and reduce fraud. These innovations are expected to improve operational efficiency and support long-term growth.

6.3 Adaptation to Regulatory Changes

Saudi Arabia’s regulatory landscape for insurance is continuously evolving, with new rules aimed at increasing transparency, solvency, and consumer protection. Tawuniya has a strong track record of compliance with regulatory requirements, and the company is well-positioned to adapt to any future changes in the regulatory environment.

Conclusion

Tawuniya Insurance Company has achieved remarkable success in the Saudi insurance market through a combination of strong brand recognition, a wide product portfolio, excellent customer service, and adherence to Islamic principles. The company’s financial performance, market leadership, and commitment to innovation make it a key player in the Kingdom’s insurance industry. As it continues to expand and evolve, Tawuniya is well-positioned to maintain its leadership and capitalize on new growth opportunities in both the domestic and regional markets.