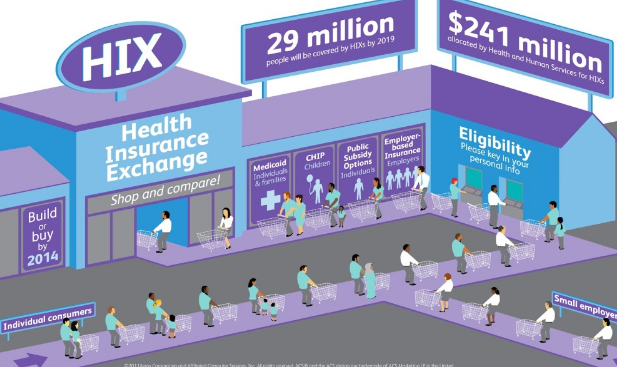

The Health Insurance Exchange, also known as the Health Insurance Marketplace, is one of the most significant features of the Affordable Care Act (ACA), commonly referred to as Obamacare. Enacted in 2010 during President Barack Obama’s administration, the ACA aimed to expand access to healthcare, improve the quality of insurance, and reduce the costs associated with medical care in the United States. The Health Insurance Exchange is a key component of this initiative, providing a platform where individuals and small businesses can shop for and purchase affordable health insurance.

This article will delve into the intricacies of the Health Insurance Exchange, the role of Obamacare in shaping this marketplace, the benefits it offers, the challenges it faces, and its overall impact on the healthcare system in the U.S. Additionally, we will explore how the marketplace works, who is eligible, and how the exchanges have evolved since their inception.

Understanding the Health Insurance Exchange

1. What Is a Health Insurance Exchange?

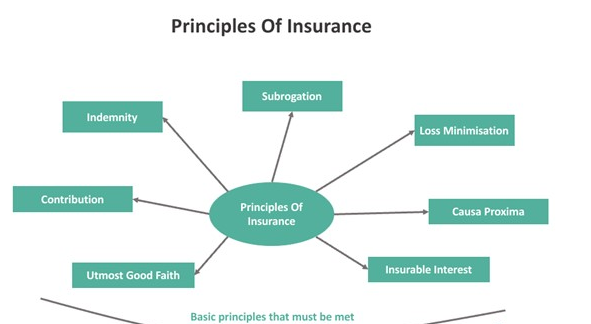

A Health Insurance Exchange is a government-run or -facilitated marketplace where individuals, families, and small businesses can compare and purchase private health insurance plans. These exchanges are designed to help consumers find affordable health insurance that meets their needs and budget. Plans offered through the exchange are standardized into four categories—bronze, silver, gold, and platinum—based on the level of coverage and out-of-pocket costs.

The primary goal of these exchanges is to create a competitive marketplace that increases transparency and helps individuals, particularly those who do not receive insurance through their employer, access coverage. They are also intended to make it easier for consumers to determine whether they qualify for subsidies or Medicaid, helping to reduce the number of uninsured Americans.

2. The Role of Obamacare in Establishing the Exchange

The Affordable Care Act (ACA) was a landmark piece of legislation aimed at reforming the American healthcare system. Before the ACA, millions of Americans were uninsured or underinsured, often because health insurance was unaffordable or because insurers could deny coverage based on pre-existing conditions. The ACA addressed these issues by creating the Health Insurance Marketplace, expanding Medicaid, and introducing regulations to protect consumers.

The marketplace established by Obamacare allows for easier access to insurance plans, standardization of coverage, and financial assistance to make insurance more affordable. The ACA mandates that all marketplace plans cover essential health benefits, which include services like preventive care, maternity care, prescription drugs, and mental health treatment. This standardization ensures that consumers receive comprehensive coverage no matter which plan they choose.

3. Federal and State-Based Exchanges

There are two types of health insurance exchanges under Obamacare: federal and state-based.

- Federally-Facilitated Marketplace (FFM): In states that opted not to create their own exchanges, the federal government runs the marketplace through Healthcare.gov. The FFM allows individuals from these states to compare plans, apply for subsidies, and enroll in coverage through the federal platform.

- State-Based Exchanges: Some states chose to operate their own exchanges, with platforms independent of Healthcare.gov. These exchanges function similarly to the federal marketplace but are managed at the state level. Examples include Covered California and the Massachusetts Health Connector. These states have more control over how their exchanges are run, including the ability to tailor outreach and enrollment efforts to their populations.

4. How the Marketplace Works

The marketplace operates as a digital platform where individuals can compare insurance plans based on coverage options, premiums, deductibles, and out-of-pocket expenses. Plans are categorized into four tiers—bronze, silver, gold, and platinum—based on the cost-sharing arrangement between the insurer and the insured:

- Bronze: Low monthly premiums but high out-of-pocket costs. The insurance company covers about 60% of healthcare costs.

- Silver: Moderate premiums and out-of-pocket costs. The insurance company covers about 70% of healthcare costs.

- Gold: Higher premiums but lower out-of-pocket costs. The insurance company covers about 80% of healthcare costs.

- Platinum: The highest premiums but the lowest out-of-pocket costs. The insurance company covers about 90% of healthcare costs.

In addition to these four metal tiers, catastrophic plans are available for certain individuals under 30 or those with a hardship or affordability exemption. These plans offer very low premiums but have high deductibles and are designed to provide coverage in case of severe health emergencies.

5. Eligibility and Enrollment

The Health Insurance Marketplace is open to most U.S. citizens and legal residents. However, some people are not eligible, including:

- Individuals who are already covered through Medicare, Medicaid, or TRICARE (the military health system).

- Individuals who have access to affordable employer-sponsored health insurance that meets ACA standards.

Enrollment in the marketplace occurs during the Open Enrollment Period, which usually takes place in the fall of each year. During this time, individuals can sign up for coverage or make changes to their existing plan. Outside of this period, individuals can only enroll if they qualify for a Special Enrollment Period (SEP), which is triggered by life events such as marriage, the birth of a child, or the loss of other health coverage.

6. Subsidies and Financial Assistance

One of the most important aspects of the ACA’s marketplace is the availability of subsidies to help make health insurance more affordable. There are two main types of financial assistance available through the Health Insurance Exchange:

- Premium Tax Credits: These are available to individuals and families with household incomes between 100% and 400% of the federal poverty level (FPL). Premium tax credits reduce the monthly premium cost for enrollees. The amount of the tax credit depends on the individual’s income and the cost of health insurance in their area.

- Cost-Sharing Reductions (CSRs): These are available to individuals with incomes between 100% and 250% of the FPL who choose a silver-tier plan. CSRs lower out-of-pocket costs, including deductibles, copayments, and coinsurance, making healthcare services more affordable.

Subsidies are essential to the success of the marketplace, as they ensure that lower-income individuals can afford the premiums and out-of-pocket expenses associated with their health insurance coverage.

Benefits of the Health Insurance Exchange

1. Increased Access to Coverage

One of the primary goals of the ACA was to reduce the number of uninsured Americans, and the Health Insurance Marketplace has played a key role in achieving that goal. The marketplace provides millions of individuals and families with access to affordable health insurance, many of whom previously could not obtain coverage due to high costs or pre-existing conditions.

2. Guaranteed Coverage for Pre-Existing Conditions

Before the ACA, many Americans with pre-existing conditions were denied coverage or charged exorbitant premiums by insurance companies. The ACA prohibits insurers from denying coverage or charging higher premiums based on health status, ensuring that individuals with chronic conditions like diabetes or cancer can access the care they need without facing discrimination.

3. Standardization of Benefits

All plans offered through the Health Insurance Exchange must cover essential health benefits, which ensures that consumers receive comprehensive coverage. This standardization means that no matter what plan they choose, individuals are guaranteed to have access to services like preventive care, prescription drugs, mental health treatment, and hospitalization.

4. Subsidies for Low- and Middle-Income Individuals

The availability of premium tax credits and cost-sharing reductions has made health insurance more affordable for millions of Americans. By reducing both premium costs and out-of-pocket expenses, the ACA’s financial assistance programs have helped many individuals and families obtain coverage who would otherwise be unable to afford it.

5. Consumer Protections

The ACA introduced a range of consumer protections, such as limiting annual out-of-pocket maximums, prohibiting lifetime coverage limits, and ensuring that insurance companies spend a certain percentage of premiums on actual healthcare services (rather than administrative costs or profits). These protections provide peace of mind to consumers, knowing that their health insurance will be there when they need it most.

Challenges and Criticisms of the Health Insurance Exchange

1. Affordability Concerns for Some

Despite the subsidies offered through the marketplace, some individuals still find health insurance premiums and out-of-pocket costs to be unaffordable, particularly those who fall just outside the income range for financial assistance. For example, individuals with incomes slightly above 400% of the federal poverty level do not qualify for premium tax credits, which can make insurance unaffordable for those in high-cost areas.

2. Limited Plan Availability in Some Areas

In certain rural or less-populated regions, the number of insurance providers offering plans through the marketplace is limited. This lack of competition can lead to higher premiums and fewer coverage options for consumers in these areas.

3. Political Instability

The Health Insurance Exchange has faced significant political challenges since its creation. Attempts to repeal or weaken the ACA, including the elimination of the individual mandate penalty (which required individuals to maintain health coverage or face a tax penalty), have created uncertainty about the future of the marketplace. This political instability has, at times, led to volatility in insurance markets, with some insurers pulling out of the marketplace or raising premiums to compensate for perceived risks.

4. Complexity of Enrollment

While the Health Insurance Exchange was designed to simplify the process of purchasing insurance, some consumers still find the system complex and difficult to navigate. Understanding the differences between plans, calculating subsidies, and determining eligibility for financial assistance can be challenging for individuals without experience in health insurance.

The Future of the Health Insurance Exchange

The Health Insurance Exchange, as part of the broader Affordable Care Act, remains a vital part of the U.S. healthcare system. Despite challenges and political opposition, the marketplace has successfully expanded access to affordable health insurance for millions of Americans.

Looking ahead, the future of the exchange will likely involve continued efforts to address affordability concerns, improve plan availability in underserved areas, and increase consumer education and outreach. The Biden administration has taken steps to strengthen the marketplace, including expanding the open enrollment period and increasing subsidies for middle-income Americans through the American Rescue Plan.

Moreover, as healthcare costs continue to rise, there will be ongoing discussions about how to make the marketplace more efficient and effective, particularly for individuals who still struggle to afford coverage. The potential introduction of a public option—a government-run health insurance plan that competes with private insurers in the marketplace—has been a topic of debate and could be a future development that shapes the exchange in the years to come.

Conclusion

The Health Insurance Exchange, a central component of the Affordable Care Act, has had a profound impact on the U.S. healthcare system. By providing a competitive marketplace for individuals and small businesses to purchase health insurance, the exchange has expanded access to coverage, improved consumer protections, and made healthcare more affordable for millions of Americans.

Despite facing challenges related to affordability, plan availability, and political instability, the marketplace continues to play a crucial role in ensuring that Americans have access to essential healthcare services. As the exchange evolves, it will be important to address these challenges and continue working toward a more inclusive and affordable healthcare system for all.