BP plc, formerly known as British Petroleum, is one of the world’s largest integrated oil and gas companies, with operations spanning exploration, production, refining, and distribution. The nature of BP’s business exposes it to a variety of risks, including operational, financial, environmental, and geopolitical risks. Effective risk management and insurance strategies are crucial for a company like BP to safeguard its assets, ensure business continuity, and protect shareholder value. This article explores BP’s approach to insurance and risk management, focusing on its risk identification, assessment, mitigation strategies, and insurance coverage to manage potential losses.

Overview of BP’s Business and Risk Environment

BP operates in a complex and high-risk industry. The company is involved in upstream activities such as oil and gas exploration and production, as well as downstream activities like refining, marketing, and distribution of petroleum products. Additionally, BP has a growing focus on renewable energy sources, as part of its strategy to transition to a lower-carbon future. Each of these segments presents unique risks that BP must manage effectively.

1. Operational Risks

- Exploration and Production: BP’s upstream activities involve drilling in remote and often hostile environments such as deepwater offshore locations, which pose significant operational risks. These include the risk of blowouts, oil spills, and accidents, which can have catastrophic consequences for the environment and the company’s reputation.

- Refining and Distribution: Downstream operations involve risks associated with the refining process, such as fires, explosions, and chemical spills. There are also logistical risks in the transportation and distribution of oil and gas products.

2. Financial Risks

- BP is exposed to fluctuations in oil and gas prices, foreign exchange rates, and interest rates, all of which can impact the company’s financial performance. Effective hedging and financial risk management strategies are essential to mitigate these risks.

3. Environmental and Regulatory Risks

- BP operates under stringent environmental regulations. Non-compliance can lead to hefty fines, legal liabilities, and reputational damage. Moreover, the company must navigate the evolving regulatory landscape as governments worldwide introduce stricter emissions standards and policies to combat climate change.

4. Geopolitical Risks

- BP operates in various countries, including politically unstable regions. Geopolitical risks such as civil unrest, sanctions, and expropriation of assets can disrupt operations and affect the company’s profitability.

5. Strategic and Reputational Risks

- Strategic risks arise from BP’s business decisions, including investments in new projects or shifts towards renewable energy. Reputational risks are particularly significant in the oil and gas sector, where incidents like the Deepwater Horizon oil spill can have long-lasting impacts on a company’s reputation and stakeholder trust.

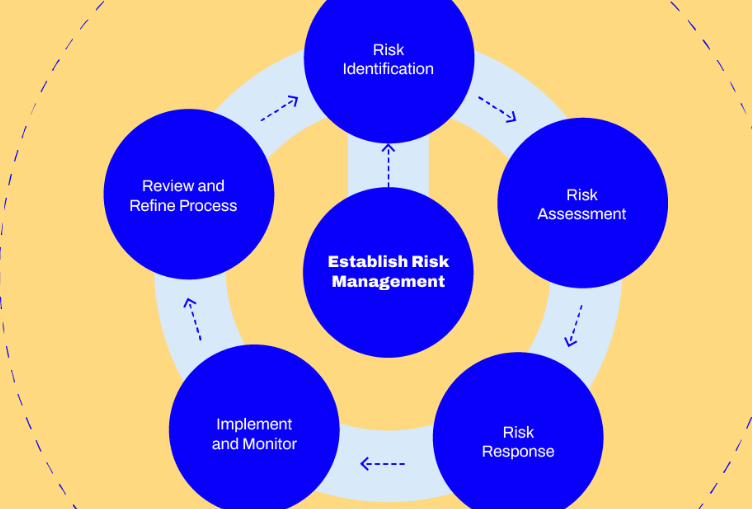

BP’s Risk Management Framework

BP has developed a comprehensive risk management framework to identify, assess, and manage the various risks it faces. This framework is embedded in the company’s governance structure and is supported by a robust set of policies, procedures, and systems.

1. Risk Governance Structure

- BP’s risk management framework is overseen by the Board of Directors and supported by various committees, including the Audit Committee, the Safety, Ethics, and Environmental Assurance Committee (SEEAC), and the Group Risk Committee. These committees are responsible for monitoring and reviewing the company’s risk management policies and practices.

2. Risk Identification and Assessment

- BP employs a systematic approach to risk identification and assessment, involving both top-down and bottom-up processes. Risks are identified at the operational level and escalated to the Group Risk Committee, which consolidates and evaluates them in the context of the company’s overall risk profile.

3. Risk Mitigation Strategies

- BP uses a combination of risk avoidance, reduction, transfer, and retention strategies to mitigate risks. For example, operational risks are managed through rigorous safety standards, regular maintenance of equipment, and comprehensive emergency response plans. Financial risks are mitigated through hedging strategies and diversification of the company’s investment portfolio.

4. Risk Reporting and Monitoring

- BP’s risk management system includes regular reporting and monitoring of key risks. The company uses a set of risk indicators to track changes in its risk profile and to trigger corrective actions when necessary.

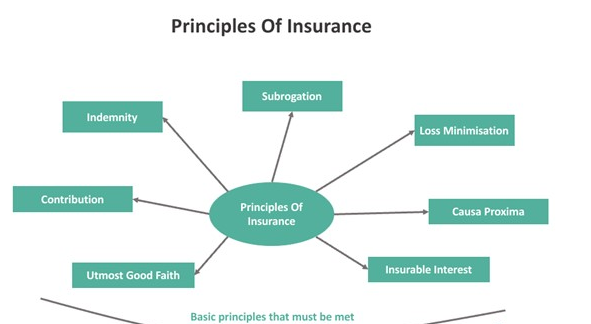

BP’s Insurance Strategy

BP’s insurance strategy is an integral part of its risk management framework. The company uses insurance as a risk transfer mechanism to protect itself against potential financial losses arising from various risks. BP’s insurance strategy is designed to complement its other risk management measures and provide a financial buffer in the event of unforeseen incidents.

1. Types of Insurance Coverage

- BP maintains a diverse portfolio of insurance policies to cover its operational, financial, and environmental risks. Some of the key types of insurance coverage include:

- Property and Business Interruption Insurance: This covers physical damage to BP’s assets, such as refineries, production facilities, and pipelines, as well as the financial impact of business interruptions caused by such damage.

- Liability Insurance: BP carries liability insurance to protect against legal liabilities arising from third-party claims, including personal injury, property damage, and environmental pollution.

- Environmental Liability Insurance: This covers the costs of environmental cleanup and restoration in the event of an oil spill or other environmental incident.

- Directors and Officers (D&O) Insurance: BP maintains D&O insurance to protect its senior management against personal liability for decisions made in their capacity as company officers.

- Cyber Insurance: With the growing threat of cyberattacks, BP has also invested in cyber insurance to cover the financial impact of data breaches and other cyber incidents.

2. Captive Insurance Company

- BP has established a captive insurance company, Jupiter Insurance Limited, to provide insurance coverage for some of its risks. A captive insurance company is a wholly owned subsidiary that insures the risks of its parent company. This allows BP to retain more control over its insurance program and potentially reduce insurance costs by retaining certain risks within the group.

3. Use of Reinsurance

- BP uses reinsurance to manage its exposure to large or catastrophic losses. Reinsurance involves transferring a portion of the risk assumed by BP’s captive insurance company or its primary insurers to other insurers or reinsurers. This helps to spread the risk and provides additional financial protection.

4. Self-Insurance

- For certain risks, BP may choose to self-insure, meaning that it retains the risk internally rather than purchasing insurance. Self-insurance is typically used for high-frequency, low-severity risks where the cost of insurance may outweigh the benefits. BP sets aside reserves to cover potential losses from these risks.

Case Study: Deepwater Horizon and its Impact on BP’s Risk Management and Insurance Strategy

The Deepwater Horizon oil spill in 2010 was a turning point for BP and had a profound impact on its risk management and insurance strategy. The incident, which resulted in the largest marine oil spill in history, highlighted the potential severity of operational risks in the oil and gas industry and the limitations of traditional insurance coverage.

1. Impact on BP’s Insurance Program

- The Deepwater Horizon incident led to significant insurance claims, with BP’s insurers paying out billions of dollars to cover some of the costs associated with the spill. However, the scale of the incident far exceeded BP’s insurance coverage, and the company had to absorb substantial losses, including fines, compensation payments, and cleanup costs.

2. Strengthening of Risk Management Practices

- In the aftermath of the spill, BP undertook a comprehensive review of its risk management practices. The company strengthened its safety and operational risk management processes, including the establishment of a dedicated Safety and Operational Risk (S&OR) function. This function is responsible for overseeing safety performance and ensuring that rigorous risk management standards are applied across the company.

3. Changes to Insurance Strategy

- The Deepwater Horizon incident also prompted BP to reassess its insurance strategy. The company increased its insurance coverage for certain risks, particularly environmental liabilities, and enhanced its use of reinsurance to protect against catastrophic losses. BP also increased its focus on self-insurance and set aside additional reserves to cover potential liabilities.

BP’s Approach to Emerging Risks

As BP navigates the transition to a lower-carbon future, it faces a range of emerging risks that require a proactive approach to risk management and insurance. Some of the key emerging risks include:

1. Climate Change and Transition Risks

- BP is exposed to both physical risks from the impacts of climate change (e.g., extreme weather events) and transition risks associated with the shift to a low-carbon economy (e.g., changes in policy, technology, and market dynamics). BP is incorporating these risks into its risk management framework and exploring insurance solutions to mitigate potential impacts.

2. Cybersecurity Risks

- The increasing digitization of BP’s operations has heightened its exposure to cyber risks. BP has strengthened its cybersecurity measures and invested in cyber insurance to protect against potential financial losses from cyberattacks.

3. Supply Chain Risks

- BP’s global supply chain is vulnerable to disruptions from natural disasters, geopolitical events, and other factors. The company is working to enhance the resilience of its supply chain and explore insurance options to cover potential losses from supply chain disruptions.

Conclusion

BP’s insurance strategy and risk management framework are integral to its ability to manage the complex and diverse risks associated with its operations. The company employs a comprehensive approach to risk identification, assessment, and mitigation, supported by a robust insurance program that provides financial protection against a range of potential losses.

The Deepwater Horizon incident was a pivotal moment for BP, prompting a reassessment of its risk management practices and insurance strategy. Since then, the company has made significant improvements to its risk management framework and expanded its insurance coverage to better protect against catastrophic losses.

As BP continues to navigate the evolving energy landscape, it faces a range of emerging risks that require ongoing vigilance and adaptation. By maintaining a strong risk management culture and leveraging its insurance program effectively, BP is better positioned to manage these risks and ensure the long-term resilience of its business.