Insurance is a fundamental component of modern financial systems, providing individuals and organizations with a way to manage risk and protect against financial loss. From health and life insurance to property and liability coverage, insurance plays a critical role in promoting economic stability and providing peace of mind. However, the concept of insurance is underpinned by a set of principles that guide how insurance policies are developed, administered, and enforced.

This article explores the key principles of insurance, shedding light on the concepts that ensure fairness, transparency, and trust between insurers and policyholders. These principles form the foundation of the insurance industry, ensuring that risks are properly evaluated, claims are fairly paid, and the entire system functions smoothly.

What is Insurance?

Before diving into the principles of insurance, it’s important to define what insurance is. At its core, insurance is a contract in which one party (the insurer) agrees to compensate another party (the insured) in the event of a specified loss or damage, in exchange for a premium. The main purpose of insurance is to transfer risk from the individual or organization to the insurance company, which pools the risk of many policyholders to provide financial protection.

Insurance operates on the principle of risk-sharing, where individuals or entities facing similar risks contribute to a common pool. In return, they receive compensation if they suffer a loss covered by the policy. However, for this system to work effectively, certain principles must be upheld by both insurers and insured parties.

The Principles of Insurance

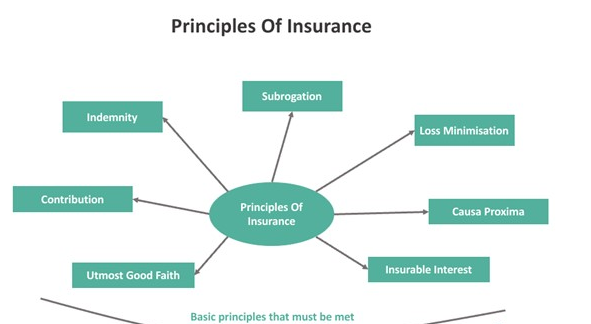

There are several key principles that govern the operation of insurance contracts. These principles are designed to ensure fairness and to maintain trust between the insurer and the insured. The seven fundamental principles of insurance are:

- Principle of Utmost Good Faith (Uberrima Fides)

- Principle of Insurable Interest

- Principle of Indemnity

- Principle of Contribution

- Principle of Subrogation

- Principle of Proximate Cause

- Principle of Loss Minimization

1. Principle of Utmost Good Faith (Uberrima Fides)

The principle of utmost good faith is the cornerstone of the insurance industry. It requires both the insurer and the insured to act in complete honesty and transparency when entering into an insurance contract. The insured must disclose all relevant information that could affect the insurer’s decision to provide coverage or determine the premium. Similarly, the insurer must clearly explain the terms and conditions of the policy, including any exclusions or limitations.

The principle of utmost good faith is important because insurance contracts rely on the sharing of accurate information. For example, when applying for life insurance, the applicant must disclose any pre-existing medical conditions, as this will influence the insurer’s decision to offer coverage and the cost of the policy. Failure to provide truthful information can result in the policy being voided or claims being denied.

Conversely, insurers must act in good faith by explaining the terms of coverage, the premium amount, and any potential limitations in a clear and understandable manner. This mutual transparency ensures that both parties are fully aware of their rights and responsibilities under the contract.

2. Principle of Insurable Interest

The principle of insurable interest states that the person or entity purchasing the insurance policy must have a financial interest in the subject matter of the insurance. In other words, the insured must stand to suffer a financial loss if the event covered by the policy occurs. This principle ensures that insurance is used as a tool for risk management rather than as a speculative or gambling instrument.

For example, if a person takes out fire insurance on a building, they must have an ownership or financial interest in the building. If the building is damaged by fire, the insured will suffer a financial loss, justifying the insurance claim. However, it would not be permissible for someone who has no financial interest in the building to take out a policy, as they would not be exposed to any real financial risk.

The principle of insurable interest helps prevent insurance fraud and ensures that policies are only issued to individuals or entities with a legitimate need for financial protection. Without this principle, insurance could be misused for profit, undermining the fundamental purpose of risk sharing.

3. Principle of Indemnity

The principle of indemnity is central to the concept of insurance, particularly in non-life insurance (such as property, liability, and health insurance). According to this principle, the insured is entitled to receive compensation only to the extent of the actual financial loss suffered. The goal of indemnity is to restore the insured to the financial position they were in before the loss occurred, without allowing them to profit from the insurance claim.

For example, if a person’s car is damaged in an accident and the repair costs are $5,000, their auto insurance policy will cover that amount. However, they cannot claim $7,000 and receive more than the actual cost of repairs. Similarly, if a homeowner’s property is damaged by a storm, they can only claim the cost of repairs or replacement up to the value of the damage, not more.

The principle of indemnity prevents moral hazard (the temptation to cause a loss to profit from insurance) and ensures that insurance is used solely to cover actual losses, not to create a financial windfall for the insured.

4. Principle of Contribution

The principle of contribution applies when multiple insurance policies cover the same risk. In such cases, the insured cannot claim the full amount of the loss from each insurer. Instead, each insurer must contribute a proportionate share of the compensation based on their respective coverage amounts.

For instance, if a business has taken out two fire insurance policies from two different insurers, each covering 50% of the value of the building, both insurers must contribute equally if a fire occurs. The insured cannot recover the full amount of the loss from both insurers, as this would violate the principle of indemnity and result in overcompensation.

Contribution ensures that the burden of a claim is shared equitably among insurers, preventing the insured from profiting by claiming more than the actual loss.

5. Principle of Subrogation

The principle of subrogation allows the insurer, after compensating the insured for a loss, to assume the legal rights of the insured to recover the loss from a third party responsible for the damage. Subrogation is commonly applied in cases where a third party is at fault for causing the loss.

For example, if a driver is involved in a car accident caused by another motorist, the insured’s auto insurance may pay for the repairs to the insured’s vehicle. However, the insurer then has the right to recover the cost of repairs from the at-fault driver or their insurance company. This process prevents the insured from receiving double compensation—once from their own insurance and again from the at-fault party.

Subrogation helps insurers recover losses from third parties and ensures that the party responsible for the damage ultimately bears the financial burden of the loss.

6. Principle of Proximate Cause

The principle of proximate cause relates to determining the exact cause of the loss when multiple events or circumstances may have contributed to it. Insurance policies typically cover certain perils and exclude others, so it’s important to identify the “proximate cause” or primary cause of the loss to determine whether the insurer is liable.

For instance, if a homeowner’s property is damaged in a fire caused by an electrical fault, the proximate cause of the loss is the fire, not the fault itself. If the insurance policy covers fire damage but excludes electrical faults, the insurer will still be responsible for covering the loss because the proximate cause (the fire) is a covered peril.

Determining proximate cause helps insurers evaluate claims accurately and ensure that policyholders receive compensation for losses covered under their policies.

7. Principle of Loss Minimization

The principle of loss minimization obligates the insured to take reasonable steps to minimize the damage or loss after an insured event occurs. The insured must act prudently to prevent further damage and protect the insured property or interest. Failure to do so could result in reduced or denied compensation from the insurer.

For example, if a person’s home is damaged by a storm, they are expected to take immediate action to prevent further damage, such as covering broken windows or repairing a leaking roof. If they neglect to take these actions and additional damage occurs, the insurer may reduce the payout or deny the claim for the preventable damage.

The principle of loss minimization ensures that both the insurer and the insured share responsibility for mitigating losses and preventing unnecessary expenses.

Importance of the Principles of Insurance

The principles of insurance are essential to the proper functioning of the insurance industry. They ensure that the contractual relationship between insurers and policyholders is based on trust, fairness, and mutual responsibility. By adhering to these principles, both parties can avoid disputes and ensure that insurance serves its intended purpose—providing financial protection in the face of unexpected losses.

Moreover, these principles help maintain the financial stability of insurance companies by preventing fraudulent claims, reducing moral hazards, and ensuring that losses are fairly distributed. Insurers rely on accurate risk assessment and proper compensation procedures to remain solvent and provide reliable coverage to their policyholders.

Conclusion

Insurance plays a vital role in managing risk and providing financial protection in an uncertain world. However, for the insurance system to function effectively, both insurers and policyholders must adhere to a set of guiding principles. The principles of utmost good faith, insurable interest, indemnity, contribution, subrogation, proximate cause, and loss minimization are the cornerstones of the insurance industry, ensuring fairness, transparency, and accountability.

By understanding and following these principles, insurers can offer reliable coverage, and policyholders can have confidence that their legitimate claims will be honored. Ultimately, the principles of insurance ensure that the system operates smoothly and continues to serve its essential role in modern society.