Aviva plc, a multinational insurance company headquartered in London, is one of the leading players in the global insurance industry, with a strong presence in life insurance, general insurance, and asset management. Aviva Life Insurance, the company’s life insurance arm, offers a diverse range of products including term life insurance, savings plans, annuities, and unit-linked insurance plans (ULIPs). This article provides a comprehensive analysis of Aviva Life Insurance, covering its history, business model, product offerings, financial performance, risk management strategies, and future outlook.

Historical Background

Aviva’s roots can be traced back to the establishment of the Hand in Hand Fire & Life Insurance Society in London in 1696, making it one of the oldest insurance companies in the world. The company underwent several mergers and acquisitions over the centuries, with the most significant being the merger of Norwich Union and CGU plc in 2000, resulting in the formation of Aviva plc. Aviva Life Insurance, as a part of Aviva plc, operates in several countries including the United Kingdom, Ireland, Canada, and various markets in Asia and continental Europe.

Aviva entered the Indian market through a joint venture with Dabur Group in 2002, forming Aviva Life Insurance India. Since then, the company has been expanding its product portfolio and distribution channels to cater to the diverse needs of the Indian market.

Business Model

Aviva Life Insurance operates on a multi-channel distribution model, offering its products through various channels including agents, bancassurance partnerships, digital platforms, and direct sales. This diversified distribution strategy enables Aviva to reach a wide customer base and cater to different market segments.

1. Product Lines

Aviva Life Insurance offers a wide range of products designed to meet the varied needs of its customers. These products can be broadly categorized into:

- Term Life Insurance: Provides financial protection to the insured’s beneficiaries in the event of the policyholder’s death during the policy term. These plans are popular due to their affordability and simplicity.

- Savings and Investment Plans: These plans combine life insurance with a savings component, allowing policyholders to build a corpus over time while enjoying life coverage. Products like endowment plans and money-back plans fall into this category.

- Unit-Linked Insurance Plans (ULIPs): ULIPs offer the dual benefits of investment and insurance. Policyholders can choose to invest in equity, debt, or balanced funds based on their risk appetite, with the added advantage of life coverage.

- Pension and Annuity Plans: Designed to provide a steady income stream post-retirement, these plans help individuals secure their financial future during retirement.

- Health Insurance Plans: Although primarily focused on life insurance, Aviva also offers health insurance products that cover critical illnesses and provide financial support in case of medical emergencies.

2. Distribution Channels

Aviva’s distribution network is a key component of its business model, enabling the company to effectively market its products and reach a broad customer base. The main distribution channels include:

- Agency Network: Aviva has a robust network of agents who play a critical role in educating customers about various products and helping them choose policies that best suit their needs.

- Bancassurance: Aviva has forged strategic partnerships with several banks, allowing it to leverage the banks’ extensive customer bases and distribution reach to sell its insurance products.

- Direct Sales and Digital Channels: In response to the growing demand for digital solutions, Aviva has invested in online platforms and mobile applications to offer a seamless customer experience. This channel is becoming increasingly important as more consumers prefer to purchase insurance products online.

- Corporate Partnerships: Aviva collaborates with corporates to offer group insurance products, including group term life insurance and health insurance, to their employees.

Financial Performance

Aviva Life Insurance has consistently demonstrated strong financial performance, underpinned by its diversified product portfolio and efficient distribution network. Key financial metrics such as premium income, profitability, and solvency ratio provide insights into the company’s financial health.

1. Premium Income

Premium income is a crucial indicator of an insurance company’s growth and market penetration. Aviva Life Insurance has shown steady growth in premium income over the years, driven by strong sales across various product segments. The company has effectively leveraged its bancassurance and agency channels to increase its premium collection.

2. Profitability

Profitability in the life insurance sector is influenced by factors such as underwriting performance, investment income, and expense management. Aviva has maintained healthy profitability by focusing on cost efficiency and prudent underwriting practices. The company’s investment strategy, which includes a diversified portfolio of equities, bonds, and real estate, has also contributed to its profitability.

3. Solvency Ratio

The solvency ratio measures an insurance company’s ability to meet its long-term obligations and is a key indicator of financial stability. Aviva Life Insurance has consistently maintained a solvency ratio well above the regulatory requirement, reflecting its strong capital position and ability to absorb potential losses.

4. Claims Settlement Ratio

The claims settlement ratio is an important metric for life insurance companies as it indicates their reliability and customer service standards. Aviva Life Insurance has maintained a high claims settlement ratio, ensuring timely payment of claims and building customer trust.

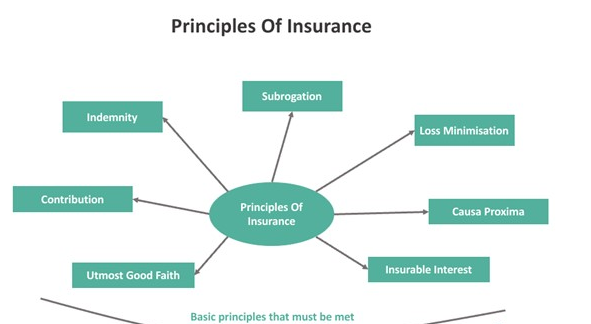

Risk Management Strategies

Effective risk management is critical for life insurance companies, given the long-term nature of their liabilities and the various risks they face, including underwriting risk, market risk, operational risk, and liquidity risk. Aviva Life Insurance has implemented a robust risk management framework to identify, assess, and mitigate these risks.

1. Underwriting Risk

Underwriting risk arises from the possibility of higher-than-expected claims due to adverse selection or incorrect pricing of insurance products. Aviva mitigates this risk through rigorous underwriting standards, regular review of its pricing models, and use of reinsurance to transfer a portion of the risk to other insurers.

2. Market Risk

Market risk is the risk of losses arising from changes in market variables such as interest rates, equity prices, and foreign exchange rates. Aviva manages market risk through a diversified investment portfolio, adherence to asset-liability management (ALM) principles, and use of derivatives to hedge against adverse movements in market variables.

3. Operational Risk

Operational risk includes risks arising from inadequate or failed internal processes, people, systems, or external events. Aviva has implemented a comprehensive operational risk management framework that includes risk assessments, internal controls, and business continuity planning to minimize the impact of operational disruptions.

4. Liquidity Risk

Liquidity risk is the risk that the company may not be able to meet its short-term financial obligations. Aviva manages this risk by maintaining adequate levels of liquid assets and cash reserves, as well as by closely monitoring its cash flows and liquidity needs.

Strategic Initiatives and Innovations

To stay competitive in the evolving insurance landscape, Aviva Life Insurance has undertaken several strategic initiatives and innovations, particularly in the areas of digital transformation, customer engagement, and sustainable investing.

1. Digital Transformation

Aviva has been investing in digital platforms and technology to enhance its customer experience and operational efficiency. The company’s digital initiatives include the development of user-friendly online portals and mobile applications that allow customers to purchase policies, make premium payments, and file claims conveniently. Aviva is also leveraging artificial intelligence (AI) and data analytics to improve underwriting processes and personalize product offerings.

2. Customer Engagement

Aviva recognizes the importance of building strong relationships with its customers. The company has launched several initiatives to enhance customer engagement, such as loyalty programs, regular communication through digital channels, and value-added services like health and wellness programs. These initiatives help Aviva build long-term relationships with its customers and improve customer retention.

3. Sustainable Investing

As part of its commitment to sustainability, Aviva has integrated environmental, social, and governance (ESG) considerations into its investment strategy. The company is actively involved in sustainable investing and has committed to achieving net-zero carbon emissions across its investment portfolio by 2040. Aviva’s focus on ESG factors reflects its commitment to responsible investing and aligns with the growing demand for sustainable investment options among its customers.

Competitive Landscape

The life insurance industry is highly competitive, with several well-established players vying for market share. Aviva Life Insurance faces competition from both domestic and international insurers, including companies like LIC, HDFC Life, ICICI Prudential, and SBI Life in India, and other global insurers in its international markets.

1. Market Position

Aviva’s strong brand reputation, diversified product portfolio, and robust distribution network have helped it maintain a competitive position in the markets where it operates. However, the company continues to face challenges from competitors who are also investing in digital transformation and expanding their product offerings.

2. Challenges and Opportunities

One of the key challenges for Aviva is navigating the regulatory landscape in different markets, as well as adapting to changing customer preferences and the increasing demand for digital services. On the other hand, the company has opportunities to capitalize on the growing demand for life insurance products, particularly in emerging markets, and to expand its presence in the retirement and health insurance segments.

Future Outlook

The future outlook for Aviva Life Insurance is influenced by several factors, including economic conditions, regulatory changes, and evolving customer needs. The company’s strategic priorities are likely to focus on digital innovation, customer-centricity, and sustainability.

1. Focus on Digital Innovation

Aviva will continue to invest in digital technologies to enhance its product offerings and customer experience. The company is expected to leverage data analytics, AI, and machine learning to optimize its underwriting processes, develop personalized products, and improve risk management.

2. Customer-Centric Approach

Aviva is likely to place greater emphasis on understanding and meeting the needs of its customers. This could involve expanding its product portfolio to include more flexible and customizable solutions, as well as improving its customer service and engagement initiatives.

3. Sustainability and ESG Integration

As the demand for sustainable products and responsible investing continues to grow, Aviva is expected to further integrate ESG factors into its business strategy and investment decisions. This focus on sustainability will not only help Aviva meet regulatory requirements but also appeal to environmentally conscious customers and investors.

Conclusion

Aviva Life Insurance has established itself as a reputable and reliable player in the life insurance industry, backed by a strong legacy, diversified product offerings, and a robust risk management framework. The company’s focus on digital transformation, customer engagement, and sustainability positions it well to navigate the challenges and opportunities in the evolving insurance landscape.

As Aviva continues to innovate and adapt to changing market dynamics, it is well-positioned to maintain its competitive edge and deliver long-term value to its customers and shareholders. However, the company will need to remain vigilant in managing risks and staying attuned to regulatory developments and customer preferences to sustain its growth and profitability in the years to come.